Permanent residency in Malta by investment

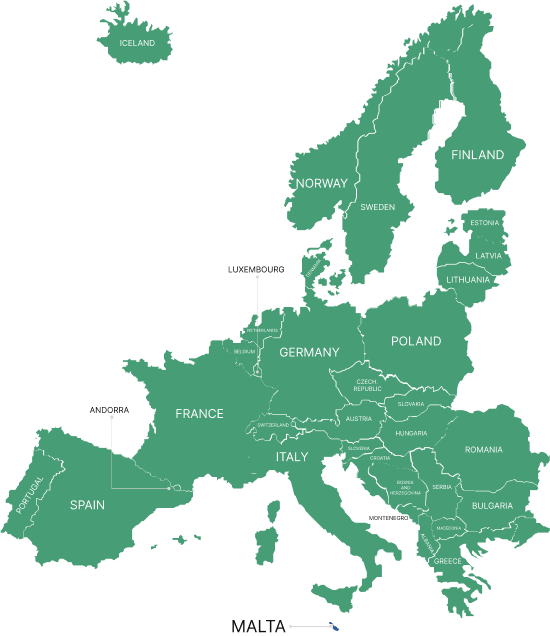

Live in Malta and explore over 45 countries visa-free

- 29 countries in the Schengen Area

- 27 countries in the European Union

- 6 countries in the Balkan Peninsula

Live in Malta and explore over 45 countries visa-free

Apply now to get expert advice

Launched on March 26, 2021, the Malta Permanent Residency Program offers foreign investors the opportunity to obtain permanent residency in Malta in exchange for a qualifying investment. To participate, applicants must possess liquid assets of at least EUR 500,000, including a minimum of EUR 150,000 in cash. The program is open to non-EU and non-EEA nationals. In addition to the main applicant, spouses, children, parents, and grandparents can also be included in the application. Permanent residence status can be obtained by purchasing real estate valued at EUR 375,000 or renting property for at least EUR 14,000 per year in Malta or Gozo. Applicants are also required to pay government contributions and make a charitable donation.

Malta permanent residency grants visa-free access to the Schengen Area, allowing stays of up to 90 days within every 180-day period.

Investors gain the right to reside permanently in Malta and have the option to rent out their property to generate income.

Permanent residents and their families can access quality education and healthcare services in Malta and other Schengen countries, without the need for additional visas.

By owning or renting property in Malta, investors secure a stable alternative residence in case of political, social, or economic instability in their home country.

Fill out the form and get a detailed guide about the service from iWorld specialists

Malta permanent residency allows investors to visit more than 45 countries without a visa, including Austria, Germany, Denmark, Ireland, the Netherlands, Norway, Finland, France, Switzerland, and Sweden.

Apply now to get expert advice

Malta permanent residency

Malta permanent residency

Greece permanent residency

Greece permanent residency

Cyprus permanent residency

Cyprus permanent residency

Portugal temporary residency

Portugal temporary residency

A thorough review of the applicant’s background is a key requirement for any investor residency program, and determines eligibility for Malta’s permanent residence. To increase your chances of approval, iWorld conducts a preliminary legal check. If any concerns are identified, we promptly find a solution.

Learn moreiWorld specialists compile the required documents for your application. We handle the translation of the full dossier into English and ensure its certification in Malta. Notarization and translation must be supported by an apostille or consular legalization issued in your country of residence.

Once the documents are complete, iWorld’s legal team submits your application to the Residency Malta Agency. At this stage, an initial administrative fee of EUR 15,000 must be paid.

The Residency Malta Agency reviews the application which takes 90 to 180 days, assuming all documents are submitted correctly. This period may be extended due to agency workload or requests for additional information.

At this stage, the remaining administrative fees are paid, the investment is made—either property rental or purchase—and the required government contribution and charitable donation are completed. iWorld submits proof of compliance to the Residency Malta Agency to obtain final approval.

You and your family members travel to Malta to complete the biometric data procedure, which is mandatory for the issuance of permanent residence cards.

Within two weeks after biometric submission, the permanent residence cards are issued. An iWorld lawyer collects them on your behalf, and they are delivered to your designated address via secure courier.

The minimum investment to participate in the Malta Permanent Residency Program is EUR 182,000.

The official processing time is 3 months as of the date of submission of the complete application package, but due to the popularity of the program, processing times are currently longer.

There are no minimum residency requirements to maintain permanent residency status. However, it is recommended that you spend 14–21 days in Malta before taking the oath of allegiance.

The application can include a spouse, unmarried children under the age of 29, financially dependent parents and grandparents of the main applicant and spouse for an additional fee of EUR 10,000 per person.

The applicant must prove that they have assets worth at least EUR 500,000 (including EUR 150,000 in financial assets) or EUR 650,000 (including EUR 75,000 in financial assets).

No, applications are only accepted through licensed agents accredited by the Malta Residency Agency. Direct applications from individuals are not considered.

There are two options: purchase of real estate worth at least EUR 375,000 and hold it for 5 years, or rent real estate for 5 years with a minimum payment of EUR 14,000 per year.

Yes, the Malta Residency Agency applies a four-level due diligence system for applicants.

Apply now to get expert advice