Residence permit in France through business

Business expansion and a pathway to EU citizenship

- Residence permit for the whole family

- Residence permit valid for 4 years from the start

- Citizenship after 5 years

- Flexible tax system

Business expansion and a pathway to EU citizenship

Apply now to get expert advice

Company registration in France allows a foreign entrepreneur to obtain a residence permit for 4 years immediately (Passeport Talent). A French business residence permit also covers a spouse and minor children. With resident status, the entrepreneur gains access to a reduced corporate tax rate for small and medium-sized enterprises, free movement within the Schengen Area, the ability to open all types of bank accounts, social services and healthcare, as well as eligibility for citizenship after 5 years.

Small and medium-sized enterprises with a turnover of up to EUR 7.63 million pay corporate tax at a rate of 15% on the first EUR 42,500 of profit, and 25% on amounts above this threshold. Dividends from French companies may be exempt from taxation under certain conditions.

Registering a company in France opens access to the single European market of more than 450 million people. Entrepreneurs gain the ability to trade freely with all EU countries without additional barriers.

Residents of France benefit from one of the best healthcare systems in the world and access to prestigious education. Children are entitled to free education in public schools and enjoy advantages when entering universities.

A French residence permit allows visa-free travel to 45+ countries, greatly facilitating international business and tourism.

France ranks among the world’s top 10 largest economies and is known for its stable legal system, ensuring strong protection for businesses and investment capital.

France ranks 30th in the global quality of life index. Its universal social security system covers nearly all residents, guaranteeing high living standards across all social groups.

After 5 years of continuous residence in France with a residence permit, applicants may apply for permanent residency or French citizenship.

France is the world’s 7th largest economy. 21% of all foreign investments in Europe are directed to France, confirming its status as a key international business hub.

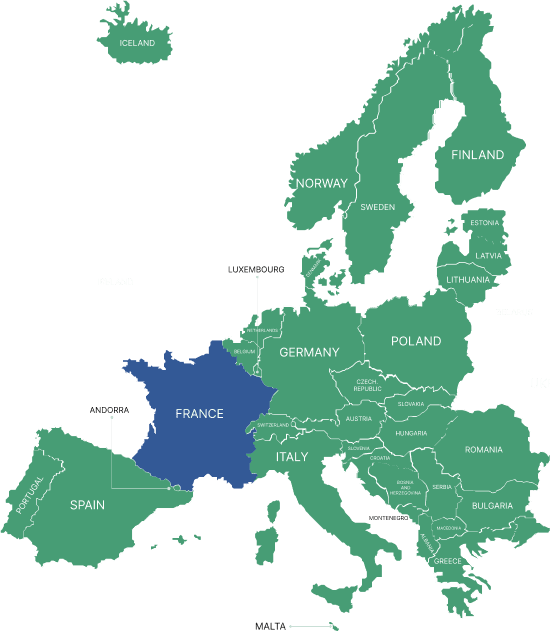

A residence permit in France provides visa-free access to 45+ countries, including Austria, Belgium, the Netherlands, Portugal, the Czech Republic, and Poland, for tourism (including medical travel), short-term study, and business purposes.

Fill out the form and get a detailed guide about the service from iWorld specialists

Apply now to get expert advice

France provides direct access to the single European market with 450 million consumers, opening up vast opportunities for scaling business and expanding internationally.

France ranks among the world’s top 5 financial centers, with reliable banks and investment institutions offering a full range of corporate services and asset management tools.

Since 2023, the unified online INPI portal has streamlined business registration, significantly speeding up company formation and reducing administrative barriers for foreign entrepreneurs.

France offers numerous business incubators, technology parks, and government innovation support programs, including La French Tech for tech startups.

The French education system ensures a steady supply of skilled professionals across all industries, while labor laws provide a stable foundation for employee rights protection.

France’s modern transport and logistics network ensures efficient distribution of goods across Europe and offers multiple channels for global market access.

French jurisdiction enjoys strong international trust, facilitating favorable contracts and consistent foreign investment inflows.

An ideal choice for small and medium-sized businesses, allowing risk limitation and maximum asset protection.

A flexible structure ideal for startups, tech companies, and international enterprises, enabling streamlined management and investment attraction.

A classic corporate structure for large businesses and participation in stock exchange operations, ensuring maximum transparency and attracting public investment.

The optimal solution for an individual entrepreneur who wants to establish a legal entity and protect personal assets.

A leading specialist from iWorld will conduct a detailed analysis of your request and select the optimal strategy for obtaining a residence permit in France through the establishment of a company. The company's specialists will determine the appropriate form of business, calculate the budget, and draw up a step-by-step plan for achieving your goal.

The prepared business concept is sent to the competent French authorities to obtain official status as an innovative enterprise. At the same time, iWorld's legal team initiates the process of obtaining a long-term type D visa, which ensures legal entry into France.

In person in France, accompanied by an accredited legal advisor, a complete set of documents is submitted to the Prefecture of Paris for consideration of the application for temporary resident status.

Upon completion of the administrative procedure, an official temporary residence card is issued, granting full rights to permanent residence, employment in France, and free movement throughout the European Union and the Schengen area.

The iWorld team will provide full support at all stages: from opening bank accounts to obtaining a tax number. The company's specialists will help you arrange insurance and ensure compliance with all requirements of French law.

France

France

Bahrain

Bahrain

Serbia

Serbia

The UAE

The UAE

There are various types of businesses available in France: sole proprietorship (Entreprise Individuelle), limited liability company (SARL), joint-stock company (SA), and simplified joint-stock company (SAS). The choice of form depends on the planned scope of activity, the number of participants, and the business development strategy.

To conduct commercial, industrial, or craft activities for more than 3 months in France, citizens of countries that are not members of the EU, EEA, or Switzerland must obtain a residence permit. A residence permit is required to legally conduct business activities and open bank accounts.

The entire process of obtaining a residence permit in France through business registration takes from 6 months. It includes setting up a company, preparing and submitting documents, reviewing the application, and obtaining a French residence card. This timeframe allows you to take all the steps into account, completing the procedure calmly and without the risk of rejection.

To obtain a residence permit, you will need: a valid visa or residence permit, documents proving your nationality, proof of residence, photographs, proof of payment of state fees, and a medical certificate from the OFII. Additionally, you will need documents proving your business registration and financial guarantees.

You can open a bank account after receiving all the company's registration documents and a resident card. French banks require confirmation of legal status in the country and documents confirming business activity.

The standard corporate tax rate in France is 25%, but small and medium-sized enterprises with a turnover of up to EUR 7.63 million pay a preferential rate of 15% on the first EUR 42,500 of profit. The standard VAT rate is 20%.

Apply now to get expert advice